Overcoming Growing Pains

When it comes to securing a large contract, the size of the order may cause any business’s cash flow to become stretched – especially when faced with suppliers demanding shorter payment terms against the backdrop of the business’s cash being tied up in invoices.

In order to maintain everyday activity at a consistent level and have the scope to seize new opportunities to facilitate growth, a maintenance solutions company approached Hilton-Baird Financial Solutions looking to find a solution to overcome the challenges associated with growing pains – in this case a mechanism to facilitate large capital outlay to satisfy a new and significant order.

After reviewing the business’s needs and the suitability of the various available options, we introduced spot factoring providers, which would allow funding to be released against the specific invoice within 24 hours of the facility being finalised. This suited our client’s requirements and supported their ability to meet the expectations of a new customer quickly, without being tied into an ongoing agreement.

We’re pleased that the client is happy with their funding facility, which provided the required flexibility and was tailored to their needs.

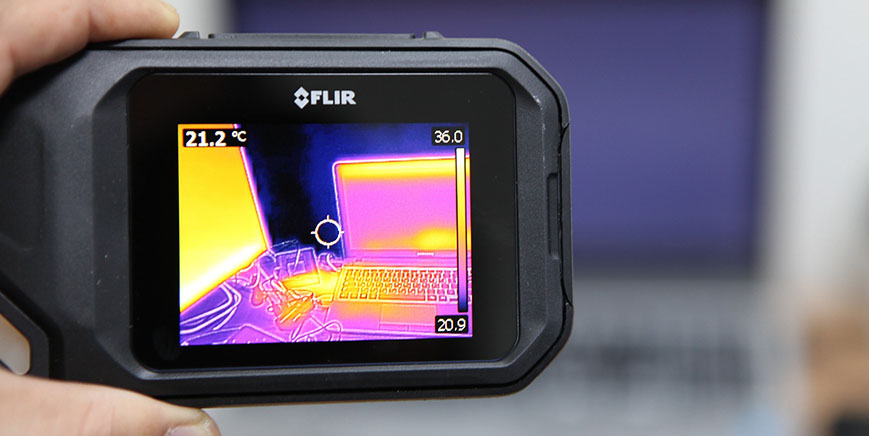

The company, which specialises in thermal imaging services including equipment and surveying, has enjoyed the functionality and practicality of single invoice factoring for several large contracts already, and is set to continue growing its order books.

If you, like our client, would benefit from the convenience of single invoice factoring, or would like to find out more about tailored funding solutions for your business, our expert team can be reached on 0800 9774833 or info@hiltonbaird.co.uk.

Get a quote