Check your eligibility for the Coronavirus Business Interruption Loan Scheme

27/03/2020

This article was updated on 06/04/2020 to reflect the government’s changes to the scheme.

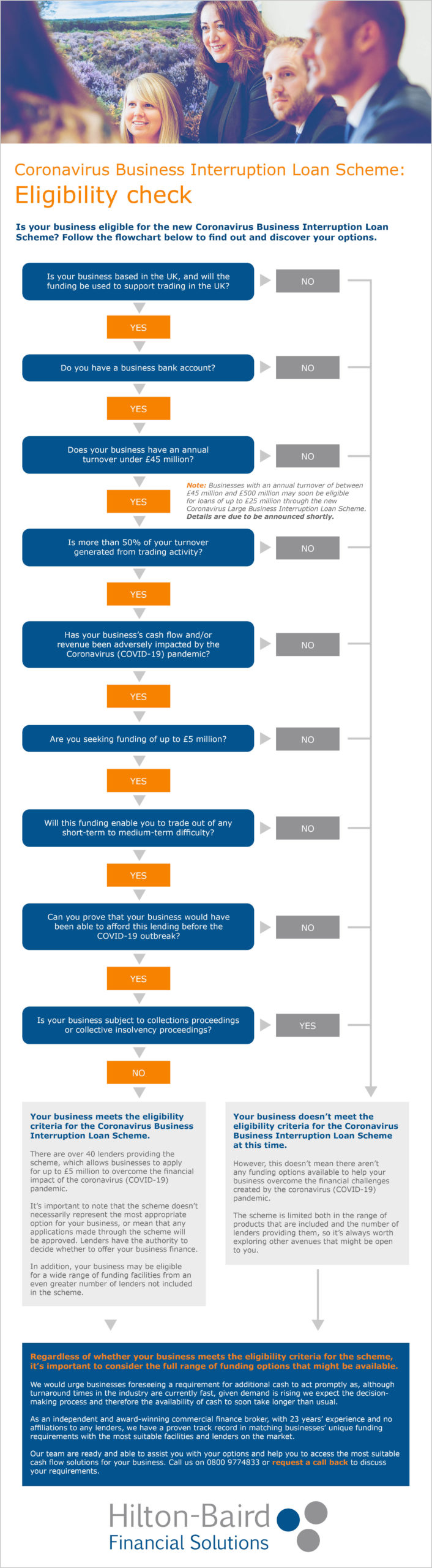

Do you know if your business is eligible for the new Coronavirus Business Interruption Loan Scheme? Could it help you to access the funding that would help you overcome the financial challenges created by the COVID-19 pandemic?

We’ve created the following infographic to help businesses quickly ascertain whether they are eligible under the scheme, which you can also open as a PDF here.

We hope you find it useful.

Please bear in mind that even if you’re eligible for lending under the scheme, this doesn’t mean any application for funding will be approved. The lender has the authority to decide whether to offer your business finance.

Get an instant quote

Should you wish to speak to our team about the loan scheme, your business’s wider funding requirements or any challenges you may be facing currently, please call our team on 0800 9774833 or request a call back here.

Comments