Easing cash flow pressure

A logistics company has secured a £500K invoice discounting facility to help them to fulfil a significant new contract.

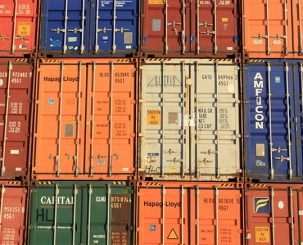

The transport management company, which specialises in lowering costs and streamlining transport requirements, took on a new contract that would see sales increase from £11m per annum to more than £28m per annum.

Whilst this was an incredibly exciting time for the growing business, they knew this new account would stretch their cash flow, so they sought a funding facility which would give them the flexibility they required going forward.

Keen to find the best facility for their exact needs, the business got in touch with the Hilton-Baird team who were able to independently assess the funding market to find the most suitable product and provider.

Invoice Discounting was identified as the most suitable facility as it allows businesses to release cash from invoices ahead of being paid, easing the cash flow pressure that large contracts can often create.

Drawing on Hilton-Baird’s sector expertise and reputable contacts, the business was introduced to appropriate funders, who we felt would be able to offer the most suitable solutions to the client’s requirements.

After assessing their options the business chose the funder they felt offered the best software package and appeared to be more supportive and creative in their approach.

Now, with the help of its flexible invoice discounting facility, the business can fulfil its new contract with a strong cash flow to sustain this growth.

If your business could also benefit from an invoice discounting facility we could help find the best solution for your requirements. Contact us today on 0800 9774833 or info@hiltonbaird.co.uk to see how our expert team could help you.