£300,000 loan helps client buy new business

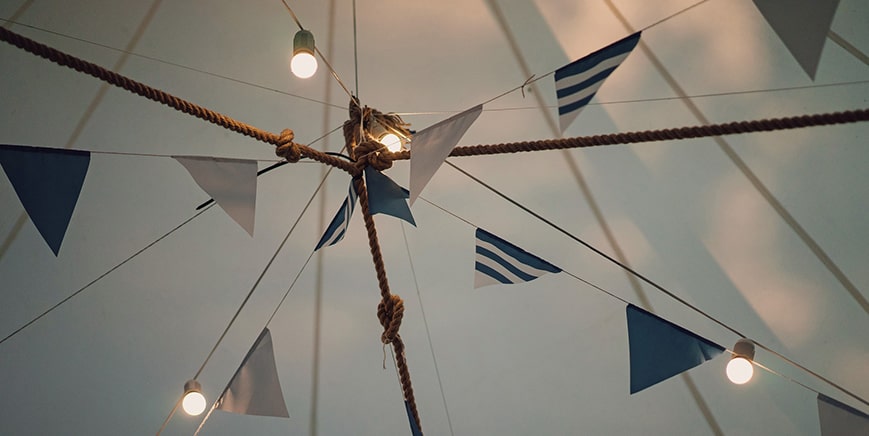

A new loan has enabled our client to secure the funding to acquire an established marquee hire company.

Having begun working in the industry during school holidays when he was 14, subsequently becoming MD of the company, our client, Steve Laycock, has extensive expertise in the event hire sector. He was keen to get back into it after a short hiatus consulting for a global event company.

Although Mr Laycock had considerable funds, he required additional capital to be in a position to acquire the target business, Abbas Marquees Limited, which supplies temporary structures for weddings and events.

After requesting an instant quote for a business loan on our website, our team made contact in order to gain further insight into his requirements and discuss his options. This led to Hilton-Baird Financial Solutions sourcing some suitable lenders and, subsequently, our client opted for a £300,000 facility at a competitive rate in order to complete the purchase.

With Mr Laycock’s experience and a high number of bookings secured for 2022 and beyond, the future is looking exciting for the business and we’re delighted to have been part of the acquisition story.

“I had a great experience working with Hilton-Baird Financial Solutions,” explained Mr Laycock. “They did everything we asked and introduced really competitive facilities that met our requirements.

“The process was easy and the team supportive. Their expertise was beneficial to us and they have helped towards our bright future.”