Coronavirus and UK businesses: Looking to the future

01/05/2020

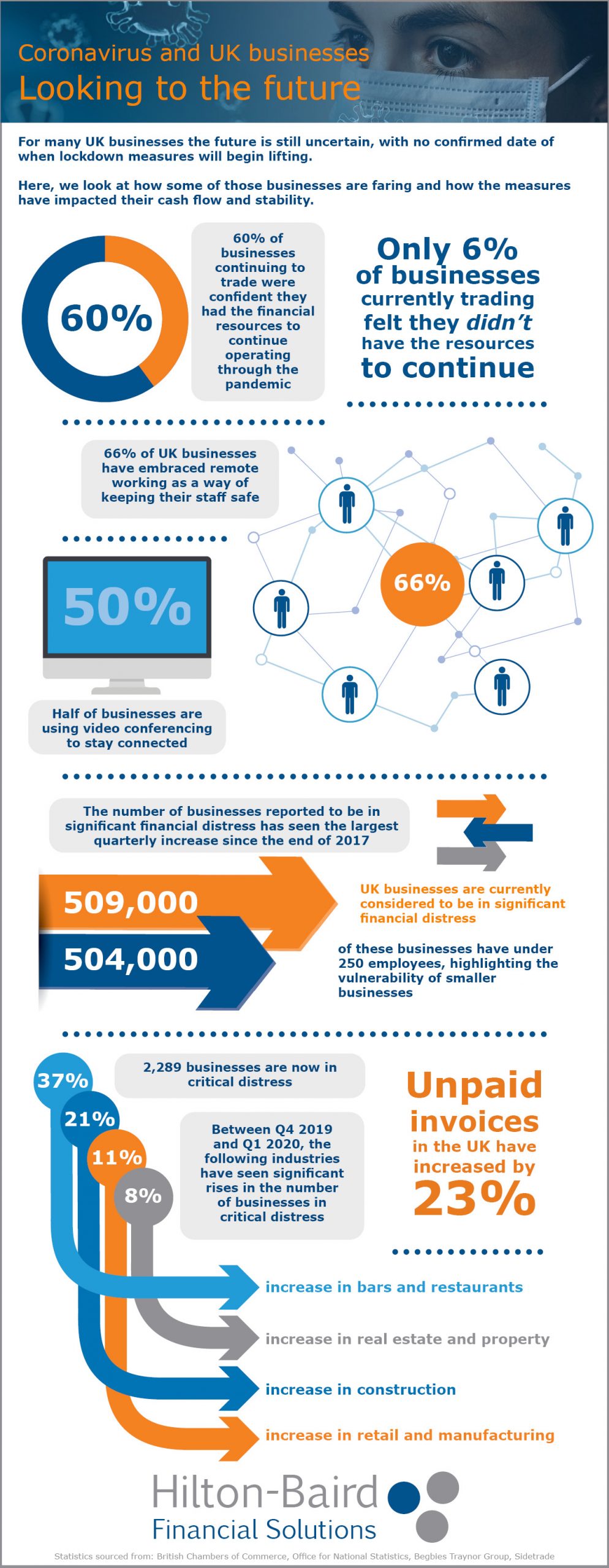

There are few definite answers for UK businesses currently wondering what impact the Coronavirus pandemic will have on their ability to trade in the future.

However, there are a number of insights that we can gain from these businesses about how they are faring, and how confident they’re feeling.

The following infographic looks at how businesses are coping with the pandemic so far, and how extensive the ongoing effects may be.

You can also take a look at our previous infographics exploring the initial impact of Coronavirus on UK businesses and how those businesses are taking advantage of support.

If you are struggling with the effects of coronavirus and are in need of commercial funding, you can reach our funding consultants by calling 0800 9774833 or using this request a call back form.

Comments