Coronavirus and UK businesses: Taking advantage of support

28/04/2020

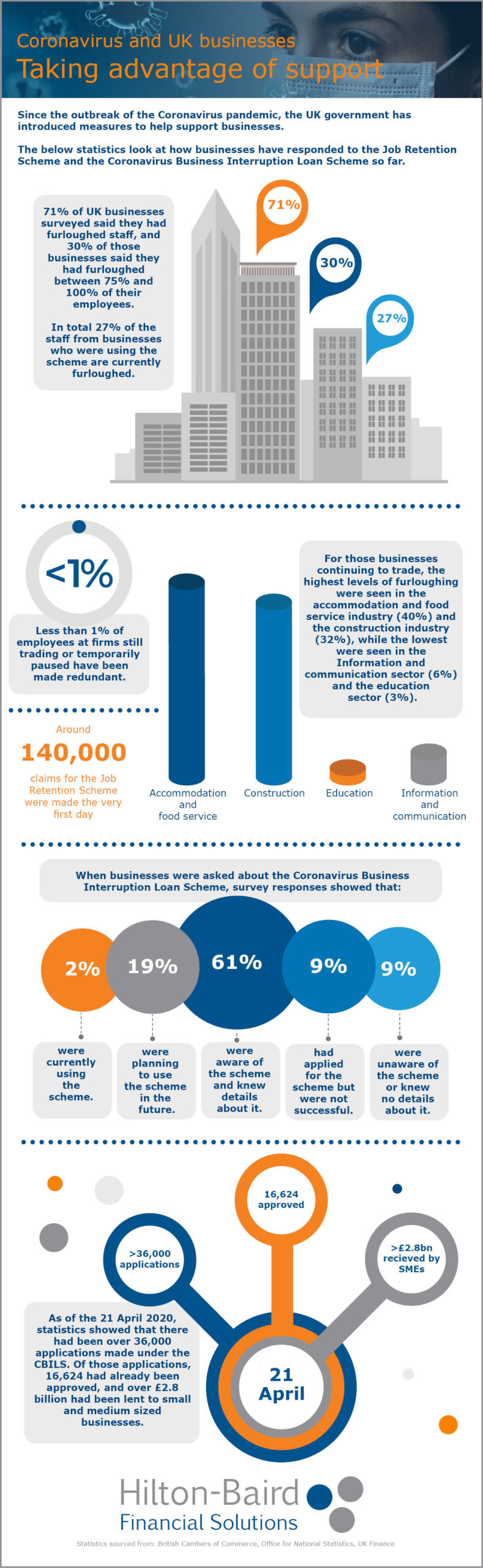

The UK government has implemented several new schemes to support businesses and their staff during the Coronavirus pandemic.

Two of the most talked about are the Job Retention Scheme, under which workers can be furloughed and be paid up to 80% of their salaries by the government, and the Coronavirus Business Interruption Loan Scheme, which aims to make loans more accessible to businesses that need them.

We’ve compiled this infographic to give an overview of how businesses have responded to these schemes and how many of the UK’s companies are currently relying on them.

You can also take a look at our infographic exploring the initial impact of Coronavirus on UK businesses here.

If you are struggling with the effects of coronavirus and are in need of commercial funding, you can reach our funding consultants by calling 0800 9774833 or using this request a call back form.

Comments