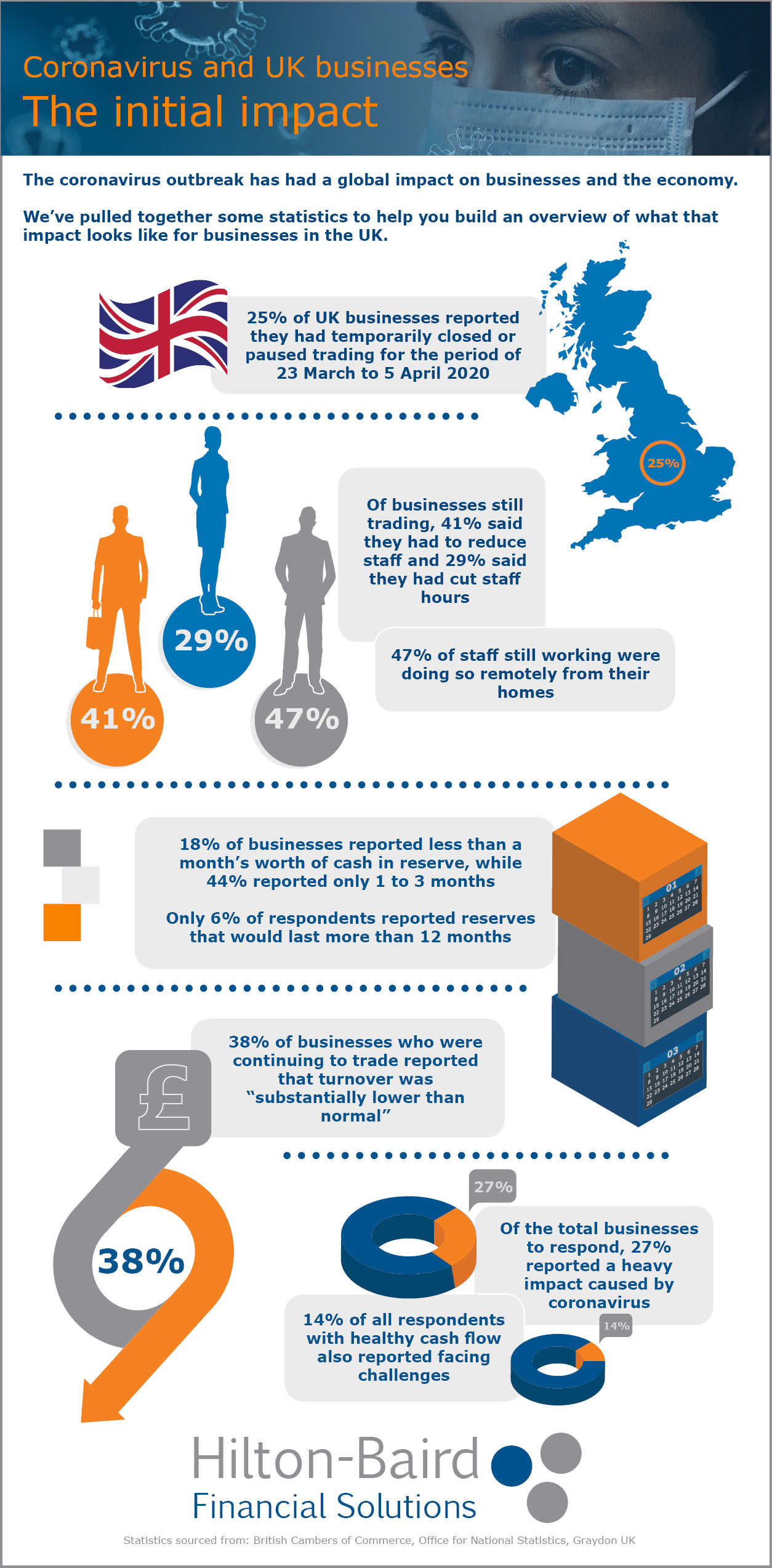

Coronavirus and UK businesses: The initial impact

24/04/2020

Coronavirus has shaken the foundations of businesses around the world.

In the UK, many businesses are just coming to terms with the initial impact of the pandemic and the measures taken to prevent its spread.

We’ve compiled this infographic to give an overview of what those businesses are facing, using early statistics that focus on the financial and personnel challenges businesses are facing and changes they have made.

If you are struggling with the effects of coronavirus and are in need of commercial funding, you can reach our funding consultants by calling 0800 9774833 or using this request a call back form.

Comments